Create a FREE account and...

Manage your own Watchlist

Access all education lessons

Converse with other crypto enthusiasts

Be a part of the Interactive Crypto Community

OR

Please fill out the required fields Please fill out the required fields Please fill out the required fields

Get Into Cryptocurrency Trading Today

Crypto scam is one of the worst in the crypto world. Investors have lost money, some with far-reaching consequences. Others have even considered suicide after they lost everything in such schemes.

Most of the projects start as any other legitimate coin. They use high-end marketing strategies with the promise of assured returns. Even though they all also exhibit signs of a scam, most people tend to assume. Most investors are after the profits than their well-being.

Here are some of the biggest scams in of all time;

The BitConnect scams remain one of the most devastating in the crypto world. Even though it started without any clear whitepaper or records, it fast took off as a significant coin. It was created by an anonymous team that employed top tier marketing strategies. While it depicted signs of a Ponzi scheme early enough, the investors heard none of it.

The company offered a very lucrative investment in returns. It promised a 40% return on investments every month. It also provided a daily 1% returns compounded over the years. These are unmanageable numbers to any sensible investor.

Still, most people took the bait. It worked such that one would have millions within a few years by investing $1000. The more one spent, the higher the promised returns.

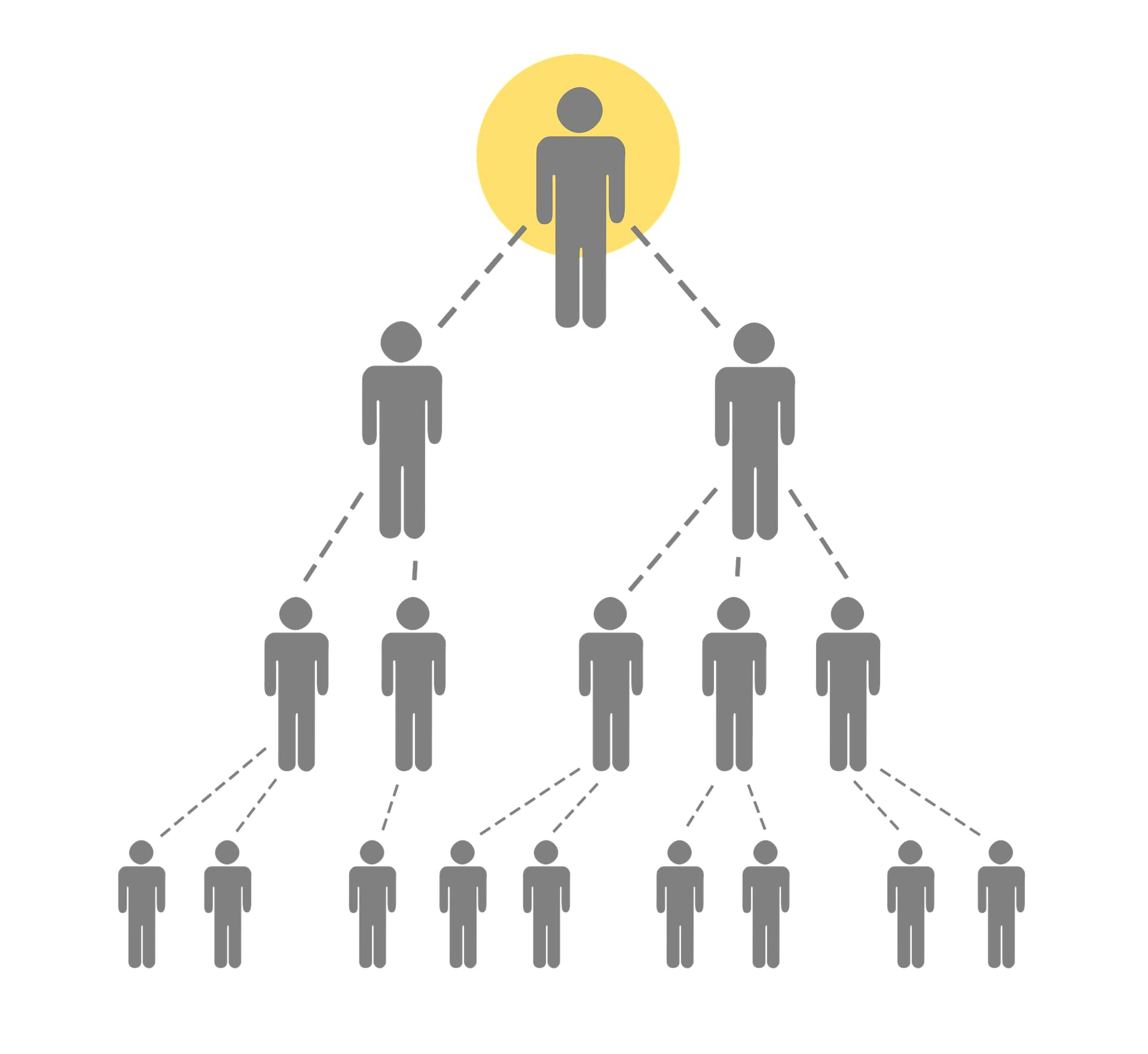

The operation model also reeked of a Ponzi scheme. It asked the users to invite other investors and gain on the attracted members. The multi-level affiliate is never part of any real venture.

Most people ignored the signs until when the company faced a lawsuit from the British Registrar of Companies. It still managed to deflect the accusations and assure users safety.

The coin had expanded so much that it was valued at $400. It had a market cap of $2.6billion. However, all this was to change when the company finally closed. The coin reduced to hit up to less than $30. It is one of the worst declines ever experienced in the crypto market.

PlexCoin is another famous crypto scam. It started in mid-2017 as a multi-functional crypto entity. Among the services were a Plex wallet, Plex Bank, and a Plex Card.

The coin attracted several investors to the lucrative earnings it offered. Even though this should have been one of the signs of its illegitimacy, it was offering assured returns of 1354% within 29 days. This, with any real market scale, is quite unmanageable for a young company.

The coin's strategy was quite successful. It raised $15 million in its first crowd sales. It was such success that also was the architect of its downfall. It soon attracted scrutiny from the financial regulators.

It started attracting several cases in court with dissatisfied investors. The Stock Exchange Commission had to freeze its assets in December 2018 due to confirmation of irregularities.

An investigation into the coin's activities found the proprietors guilty of financial crimes. Dominic Lacroix and Sabrina Paradis-Royer, the founders, had to face charges for defrauding the public in 2018.

PlexCoin is one of the rare cases where investors got back a little of what they had put in. They had to wait for a whole year before accessing the funds. In July 2018, the court ordered the investors to return $3million in BTC to the users. Still, this was way little than the higher initial investments.

It winded up in January of 2018. Most of the brains behind the scheme have been arrested. However, the investors have never recovered losses.

Launched in 2015, Onecoin is another widespread scam in the crypto world. While the media and experts were sceptical about the coin early enough, the coin had an excellent marketing counter-strategy. It held various international seminars promising clients of all the fantastic returns.

Onecoin, however, became more suspect when users realized it does not have any blockchain system. The financial regulators and journalists started reviewing the firm. The company's leaders, on the other hand, started threatening the media.

It all went down with the top leaders arrested for financial irregularities. The investors lost everything they had put in the company.

CentraTech started as a crypto card service provider. It was making it easier to hold and access the cryptos. It also provided a platform to buy, sell, or hold the coin.

The platform attracted masses due to the intense celebrity advertisements it employed. Top celebrities like Floy Mayweather and DJ Khaled endorsed the coin. Such tactics helped it raise more than $32million through the ICO.

The success would make it a matter of interest to the financial regulators. It had seemed legit as it had a list of experienced top executives. Not for long, though. Within a few months, Visa denied any cooperation between them. MasterCard also denied any partnership with the company.

The company would not survive the setback for long. The authorities arrested 2 of the founders in February 2018. With the last of the three getting detained later in the year.

These events ultimately led to its crash. The investors lost all their money.

Created in January 2018, Pincoin is one of the largest exit scams ever. It made away with over $660million raised from over 32,000 investors.

The company had a successful marketing strategy to attract potential investors. It came with a stunning whitepaper detailing all the great things about the coin. It also promised assured high rates of returns. It offered investors 48% monthly returns. It also had a wonderfully designed website with needed information.

After the successful launch, it also introduced iFane. It was offered as a token network for celebrities. It was also quite successful. Even though most of the ideas seemed unrealistic, most investors never took heed. The company had promised to launch about eight blockchain products.

After some time, the investors got suspicious of the coin trading. They could not access any money through the blockchain technology. By the time they were visiting the site office, it was all deserted. All the 7 Vietnamese founders of the company got away. They headed to an undisclosed location with all the money seemingly gone.

Apart from coin offerings, the exchange platforms have also been a hit among scammers. One of the most successful is that of the 2 Israeli brothers who offered non-existent exchanges. They lured investors from various social media like Reddit.

The users would then rely on their site for holding crypto. It vanished after three years with all the customer funds. It had over $100million. Even though the brothers were arrested in June 2019, the investors are yet to recover their funds.

Scams are widespread in the crypto world. Even the coin that looks like a sure investment can turn to be the worst. Investors need to stay vigilant while putting their money on any project. There is a need for due diligence. They have to confirm regulations and security provisions.

Also, take note of any pyramid scheme like feature. Don't fall for any deal that seems too good to be true. A multi-tire affiliate program is another sign of a scam.

Create a FREE account and...

Manage your own Watchlist

Access all education lessons

Converse with other crypto enthusiasts

Be a part of the Interactive Crypto Community

ALL

TRENDING

WATCHLIST

Total Market Cap The Total Market Capitalization (Market Cap) is an indicator that measures the size of all the cryptocurrencies.It’s the total market value of all the cryptocurrencies' circulating supply: so it’s the total value of all the coins that have been mined.

{[{ marketcap }]} {[{ marketcapchange.toLocaleString(undefined, {maximumFractionDigits:2}) }]}% (24H) {[{ marketcapchange.toLocaleString(undefined, {maximumFractionDigits:2}) }]}% (24H)

Symbol

Price Cryptocurrency prices are volatile, and the prices change all the time. We are collecting all the data from several exchanges to provide the most accurate price available.

24H Cryptocurrency prices are volatile… The 24h % change is the difference between the current price and the price24 hours ago.

Trade

{[{ item.name }]}

{[{ index + $index}]}

{[{ item.pair.split('_')[0] }]}

Ƀ{[{item.price.toLocaleString(undefined, {maximumFractionDigits: 5}) }]} ${[{item.price.toLocaleString(undefined, {maximumFractionDigits: 5}) }]}

{[{ item.change24.toLocaleString(undefined, {maximumFractionDigits: 2}) }]}%

{[{ item.change24.toLocaleString(undefined, {maximumFractionDigits: 2}) }]}%

Symbol

Price Cryptocurrency prices are volatile, and the prices change all the time. We are collecting allthe data fromseveral exchanges to provide the most accurate price available.

24H Cryptocurrency prices are volatile… The 24h % change is the difference between the current priceand the price24 hours ago.

Trade

{[{ item.name }]}

{[{ index + $index}]}

{[{ item.pair.split('_')[0] }]}

Ƀ{[{item.price.toLocaleString(undefined, {maximumFractionDigits: 5}) }]} ${[{item.price.toLocaleString(undefined, {maximumFractionDigits: 5}) }]}

{[{ item.change24.toLocaleString(undefined, {maximumFractionDigits: 2}) }]}%

{[{ item.change24.toLocaleString(undefined, {maximumFractionDigits: 2}) }]}%

JustBit Casino Review

JustBit Casino, which specializes in virtual currencies, is easy to use because withdrawals are expl...

Huobi Token General Overview

Is Ripple The Cryptocurrency of 2021? - In Depth Review of Ripple XRP

Ethereum Classic Review

Monero General Overview

YouHolder

YouHodler is not just another player in the crypto space; it's a dynamic and innovative company ...

XBO

XBO.com cryptocurrency exchange redefines how you interact with crypto. Designed to make the benefit...

Bithumb

Understanding Bithumb This article highlights what is Bithumb and where it is located. It also di...

Bitstamp

Bitstamp's continued success in the crypto market This article highlights what Bitstamp is. I...

Bitfinex

Bitfinex general overview delves deep into its operations since its inception in 2012 up to date. It...

(adsbygoogle = window.adsbygoogle || []).push({}); Introduction In t...

(adsbygoogle = window.adsbygoogle || []).push({}); Einführung Wenn es um Er...

Mobi

Are you someone who makes international payments regularly using Bitcoin? Or do you travel a lot and...

Bitcoin.com

Bitcoin.com is a free downloadable Bitcoin wallet that allows users to trade and receive Bitcoins. T...

BTC.com

Created by Bitmain in 2016, BTC.com is a leading open-source Bitcoin and Bitcoin Cash storage platfo...

Crypto Scams of All Time

Crypto scam is one of the worst in the crypto world. Investors have lost money, some with...

Bitcoin, Ethereum and Litecoin Price Analysis

The major cryptocurrencies are attempting to rebound near support. Prices are moving into...

Santander Expands to use Ripple to send Money to US

Santander, a major banks across the globe, has announced that it will be using Ripple’s...

Should You Buy Bitcoin in 2021? - Bitcoin (BTC) Review

Fiat currencies have been the economy holders for the longest time. The governments and central...

(adsbygoogle = window.adsbygoogle || []).push({}); Introduction In t...

(adsbygoogle = window.adsbygoogle || []).push({}); Einführung Wenn es um Er...

Mobi

Are you someone who makes international payments regularly using Bitcoin? Or do you travel a lot and...

Bitcoin.com

Bitcoin.com is a free downloadable Bitcoin wallet that allows users to trade and receive Bitcoins. T...

BTC.com

Created by Bitmain in 2016, BTC.com is a leading open-source Bitcoin and Bitcoin Cash storage platfo...

COMMENTS (0)